Stonewell Bookkeeping Can Be Fun For Anyone

Wiki Article

The Main Principles Of Stonewell Bookkeeping

Table of Contents9 Simple Techniques For Stonewell BookkeepingThe Only Guide to Stonewell BookkeepingIndicators on Stonewell Bookkeeping You Need To KnowStonewell Bookkeeping Can Be Fun For AnyoneThe 20-Second Trick For Stonewell Bookkeeping

Below, we respond to the concern, exactly how does bookkeeping help a company? In a feeling, accountancy books stand for a picture in time, but only if they are upgraded usually.

None of these final thoughts are made in a vacuum as accurate numerical info must strengthen the monetary decisions of every little company. Such information is assembled through bookkeeping.

Still, with appropriate money circulation management, when your books and journals are up to date and integrated, there are far less enigma over which to fret. You understand the funds that are offered and where they fail. The news is not constantly great, however at the very least you understand it.

4 Easy Facts About Stonewell Bookkeeping Described

The puzzle of reductions, credit reports, exceptions, timetables, and, naturally, penalties, suffices to just give up to the IRS, without a body of efficient documentation to support your insurance claims. This is why a committed accountant is indispensable to a local business and is worth his/her king's ransom.

Your business return makes claims and depictions and the audit targets at verifying them (https://penzu.com/p/5be3889060f82eef). Good bookkeeping is all about connecting the dots between those depictions and truth (best franchises to own). When auditors can comply with the details on a journal to receipts, bank statements, and pay stubs, among others documents, they quickly discover of the proficiency and integrity of business organization

The Best Guide To Stonewell Bookkeeping

In the exact same method, slipshod bookkeeping contributes to anxiety and anxiousness, it visit this website likewise blinds local business owner's to the possible they can understand over time. Without the info to see where you are, you are hard-pressed to establish a destination. Only with understandable, thorough, and factual data can a service proprietor or management team story a training course for future success.Organization owners recognize best whether an accountant, accounting professional, or both, is the appropriate solution. Both make vital contributions to an organization, though they are not the exact same profession. Whereas an accountant can collect and arrange the information needed to sustain tax obligation prep work, an accountant is much better matched to prepare the return itself and actually analyze the income declaration.

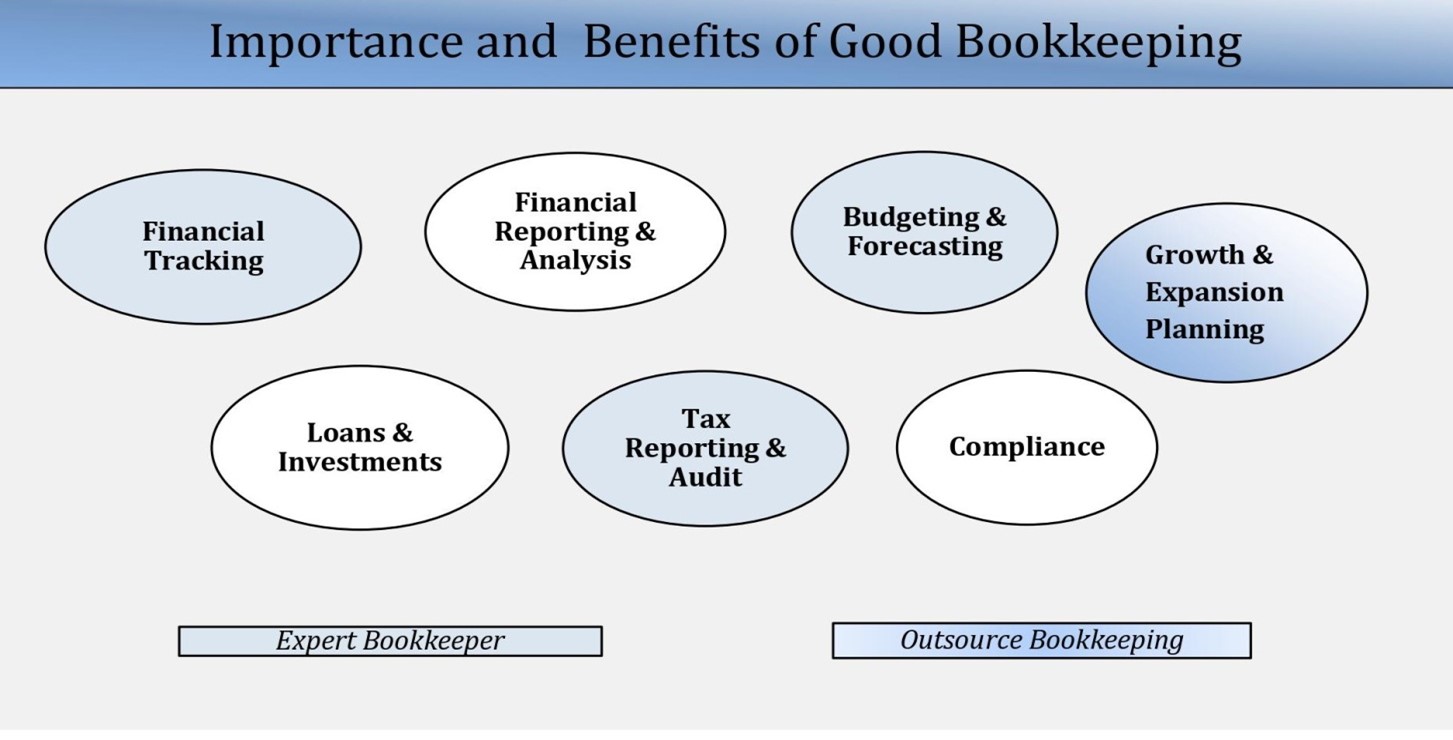

This short article will explore the, including the and how it can benefit your business. We'll also cover just how to get going with bookkeeping for an audio monetary ground. Bookkeeping includes recording and organizing monetary purchases, consisting of sales, purchases, settlements, and invoices. It is the process of keeping clear and succinct records to make sure that all economic information is conveniently obtainable when required.

This short article will explore the, including the and how it can benefit your business. We'll also cover just how to get going with bookkeeping for an audio monetary ground. Bookkeeping includes recording and organizing monetary purchases, consisting of sales, purchases, settlements, and invoices. It is the process of keeping clear and succinct records to make sure that all economic information is conveniently obtainable when required.By on a regular basis upgrading economic records, accounting aids businesses. Having all the financial details quickly accessible keeps the tax obligation authorities satisfied and stops any last-minute frustration throughout tax filings. Normal bookkeeping guarantees well-maintained and organized records - https://www.lidinterior.com/profile/stonewellbookkeeping7700262003/profile. This aids in conveniently r and conserves companies from the stress of looking for records throughout target dates (bookkeeping services near me).

The 7-Second Trick For Stonewell Bookkeeping

They also want to know what possibility the business has. These elements can be conveniently managed with bookkeeping.Therefore, accounting helps to stay clear of the inconveniences related to reporting to financiers. By maintaining a close eye on monetary records, companies can establish practical goals and track their progression. This, consequently, promotes much better decision-making and faster organization growth. Federal government guidelines typically call for businesses to preserve financial records. Normal accounting ensures that companies stay certified and avoid any penalties or lawful issues.

Single-entry accounting is simple and works best for little organizations with couple of purchases. It entails. This method can be compared to keeping a straightforward checkbook. It does not track possessions and obligations, making it much less extensive compared to double-entry accounting. Double-entry bookkeeping, on the other hand, is extra advanced and is usually taken into consideration the.

Stonewell Bookkeeping Fundamentals Explained

This could be daily, weekly, or monthly, relying on your organization's dimension and the volume of purchases. Don't hesitate to look for aid from an accountant or accountant if you locate managing your monetary documents challenging. If you are looking for a free walkthrough with the Accountancy Solution by KPI, call us today.Report this wiki page